Africa emerges as new standard-bearer of free trade

Some members of the WorldRemit team came together with predictions for fintech and trade in 2019. Here's my contribution on the future of inter-African trade in the New Year:

Prediction: Africa emerges as new standard-bearer of free trade

Ten years ago, the G20’s rejection of protectionism helped the global economy weather one of its most difficult periods. Now, a decade later trade protectionism seems on the rise. Recent research shows that world’s top 60 economies have adopted more than 7000 protectionist trade measures on a net basis since the financial crisis.

But as countries like the US and UK turn inward, Africa is opening up. In March, 44 countries signed the establishment of the African Continental Free Trade Area, the largest free trade agreement since the creation of the World Trade Organisation.

Africa, which covers approximately 30 million square kilometres, is the second-largest continent in the world. By 2050, 1 in 4 people worldwide will be African. But despite its vast geography and rapidly growing population, the region’s economy remains small. But as Africa grows by 2.7% annually (a figure that more than doubles if you exclude resource-dependent economies like Nigeria, Angola and South Africa), here are our predictions for African regional integration in 2019.

Inter-African trade is likely to rise by 8% in 2019. Small countries will lead the charge.

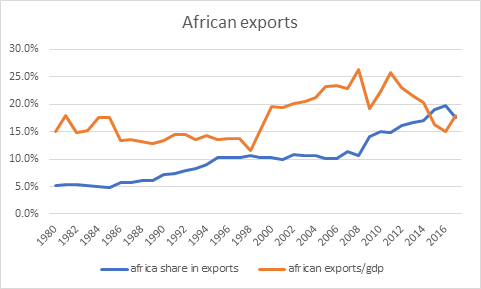

Inter-African trade (the share of African countries’ exports to destinations within the continent) was 17.6% of the total in 2017. On this metric, African economies have become substantially more integrated in recent years (see figure 1). This integration was driven by improvements in transport and communications infrastructure, falling trade tariffs (see figure 2) and the pull of economic ‘gravity’ as trade flows are diverted towards rapidly growing and often neighbouring economies. The IMF forecasts African GDP to grow by 3.9% in 2019 in real terms — 7.7% in US dollar terms. If the total export-GDP ratio rises part of the way back towards recent highs, and the share going to Africa does the same, the volume inter-African exports could rise by 8% or more in 2019, and by 12% in US dollar terms.

Countries with the highest levels of regional integration tend to be smaller and to import significant shares of their neighbours’ GDP, and so can drive growth at the regional level. This is particularly true in East and Southern Africa, where 20.6 and 20.3 of exports are exchanged within the region, respectively.

Progress on closing the infrastructure gap

Africa’s annual infrastructure gap — the difference between what it has and what it needs — is now estimated at around $170 billion. According to the World Bank, narrowing the region’s infrastructure gap in line with the rest of the developing world would increase GDP per capita by an estimated 1.7percentage points per year, with the largest potential growth benefits generated by improving access to electricity.

Growing capital deployment by Africa-focused multi-lateral finance institutions formed within the last decade such as Africa Finance Corporation (AFC), Africa50, and Anergi as well as the announcement of Allianz Global Investors (AGI)’s $120 million investment in the Emerging Africa Infrastructure Fund points to a bright future for African infrastructure in 2019.

Pictured: Opened in 2019, the Maputo-Katembe bridge, Africa’s longest suspension bridge, measures 3km in length and will connect travellers between South Africa and Mozambique in record time. Travel time now reduced from six hours to 90 minutes.

More Africans will find it easier to travel across the continent

2018 was a major turning point as the launch of the Single African Air Transport Market and ongoing progress of the African Union’s visa openness initiative made it faster, less expensive and easier than ever for Africans to travel within the region. Today, Africans do not need a visa to travel to 25% of other African countries and can now get visas on arrival in 24% of other African countries. Ethiopia, Africa’s diplomatic capital and one of the region’s key aviation hubs, for example, began offering visa on arrival to all Africans starting from November 9, 2018. Air traffic in Africa is forecast to grow 6 percent per year, twice as fast as mature markets and faster than any other region over the next two decades. Improved regional agreements and demand should help lower costs for consumers.

Regional financial integration through increased mobile money interoperability will rise

McKinsey Global Institute estimates that widespread adoption and use of mobile money could add $3.7 trillion to the GDP of emerging economies within a decade. Mobile money interoperability is common in East and Central Africa as well as between Zimbabwe and South Africa, but in 2019 we predict that this trend will accelerate.

In late November, Orange Group and MTN Group, leading African telecoms providers, announced a joint venture, Mowali to enable interoperable payments across the continent. The joint venture will bring together 100 million Orange Money and MTN Money users in 22 African markets.

Members of the West African Economic Monetary Union (WAEMU) — a group of eight primarily francophone West African states within the ECOWAS — are building an interoperable system that will connect 110 million people to more than 125+ banks, dozens of e-money issuers, and 600+ microfinance institutions by the end of next year.

These partnerships will help more Africans across the continent receive better access to financial services, particularly in under-served rural communities.

So what does this mean for Africans?

Although the continent’s youth bulge is often cited in negative terms in terms of net migration, it is also means that a young and eager workforce, increasingly educated and hungry for opportunity, has a brighter future.

Africa’s trajectory in 2019 is to be more interconnected, more dynamic than ever, and a place where entrepreneurs can find a market for their innovation. Since 2016, for example, the number of active tech hubs across Africa has grown by more than 50% to 442 according to the telecoms industry body, GSMA. Hurdles like the most expensive data costs in the world remain and cost of living can be high, but the long arc of development bends towards continued progress in the coming year.